The revolution

in financial wellbeing

YincQ, the new standard in financial self-reliance.

The value for

organizations

- Improvement and optimisation of employees’ financial self-reliance

- Less absence and stress, more engagement and productivity

- HR support for financial wellbeing and prevention policies

- Profiling as a caring, future-oriented employer (ESG, CSR)

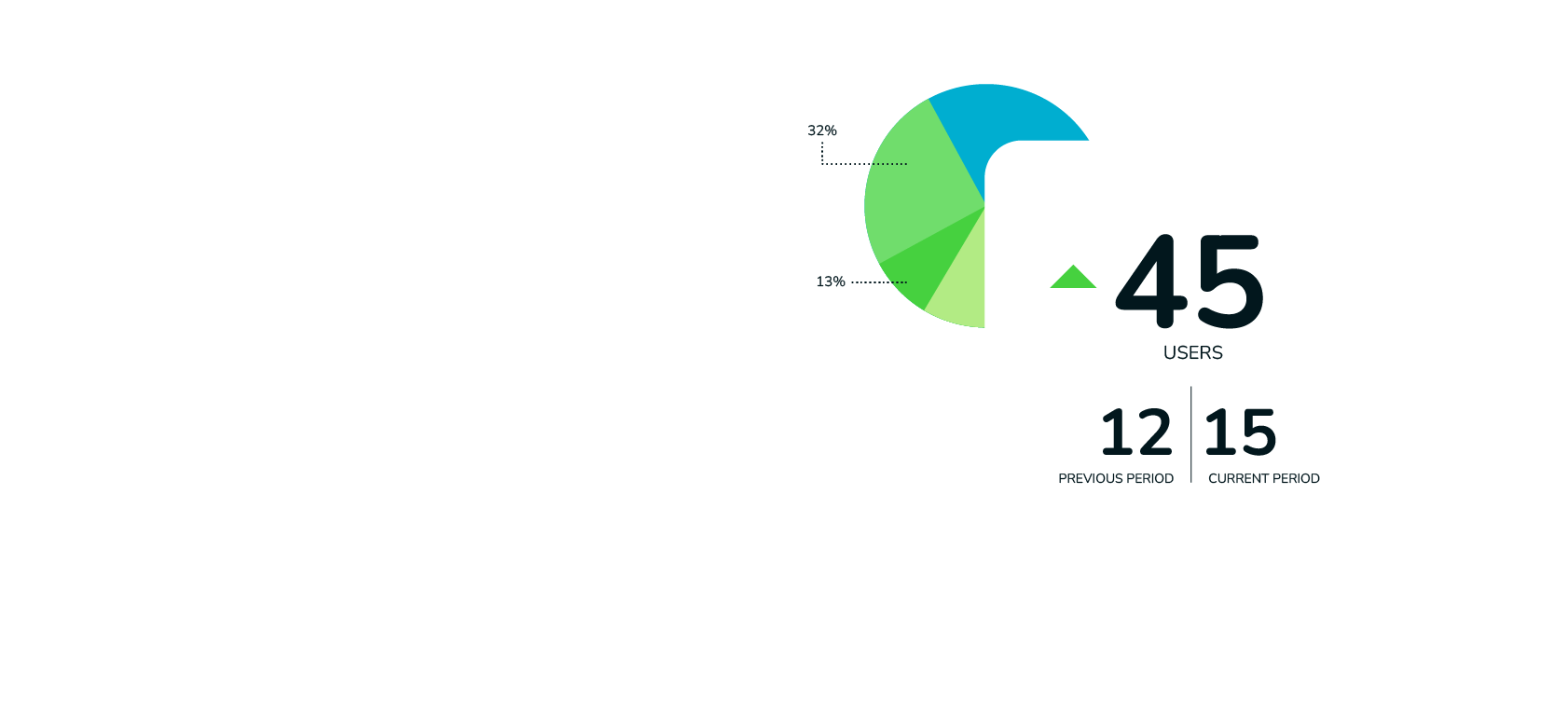

- Anonymised feedback and benchmarks for continuous improvement

The impact for

employees

- Control over money, future and financial choices (pension, savings, mortgage, loans)

- Personal insights and guidance via AI support

- Less stress, more peace of mind and confidence in your own situation

- Direct access to help, information and tailored advice

- Anonymised feedback and benchmarks for continuous improvement

Financial self-reliance in practice

We are in development

Frequently asked questions

Why focus on your employees' financial health?

YincQ helps your employees gain control of their financial health by empowering them to become self-reliant. Fewer worries mean more peace of mind and confidence in decisions for your employees, but also for the employer.

Investing in the financial well-being of employees is investing in the long-term employability of positive, healthy employees.

Healthy and carefree into the future.

How does the AI Financial Coach work in your company portal?

YincQ offers a revolution in financial consultancy. All our knowledge and experience about financial wellbeing is housed in a knowledge platform.

We know better than anyone that every person and every situation is unique. With your own company portal, we can provide personalised and targeted information and advice to your employees. It is a central place where your employees can anonymously and personally ask financial questions and receive answers tailored to their own needs and wishes.

This gives them more insight into and control over their own finances and financial future, such as pensions, savings, mortgages, loans, studying, and so on. It offers 24/7 digital support and makes financial consultancy available to everyone.

And if extra support is needed? Then YincQ provides human contact to answer complex questions in consultation with you.

What about the security and privacy of data and personal information?

All data is stored and processed in encrypted form in accordance with high security standards. YincQ is ISO 27001 (information security) and ISO 9001 (quality management) certified.

Your company data and information are only available to your organisation. Your employees’ personal data and information are not shown to your organisation and are only processed anonymously in reports and statistics. You can therefore give your organisation and employees access to your company portal with complete confidence.

What will it cost my organisation?

YincQ 2.0 is the new platform with a completely new approach to sharing knowledge and expertise. Depending on the size and structure of your organisation, we offer a tailor-made business subscription.

Would you like to know what this means for you? Please contact us at sales@yincq.com

How can my organisation get started with YincQ?

Please contact us for an introduction and a demonstration.

Once you have chosen YincQ, we will set up your company portal, after which you can invite your employees to create a personal account. If desired, we can also arrange this for you.

Make an appointment for a demo via sales@yincq.com or call us on +31 (0)88 27 701 00.

What does financial health mean?

Greater knowledge and control of your financial situation means fewer worries. Financial health means having insight, gaining an overview and not having to worry about whether you have enough left over each month, how your pension is arranged or what you can do to save extra.

YincQ helps you gain control of your financial health by empowering you with tailored advice and tips.

Healthy and supported into the future.

How does the AI Financial Coach work?

We have gathered all our knowledge about financial health in one central location where you can ask all your questions and get immediate insight.

We know better than anyone that every person and every situation is unique. In your dashboard, you can create your own personal and financial profile, set your wishes and goals, and then receive suggestions and advice from our online AI Financial Coach. This AI Financial Coach gives you immediate answers, personal insights and practical tips. This gives you more control over your own finances and financial future, such as your pension, savings, mortgage or studies.

You manage your own account and have 24/7 access to financial consultations 365 days a year to work on your financial well-being and that of your family or partner.

How secure is my data?

We take the protection of your personal data very seriously and take appropriate technical and organisational measures to prevent misuse, loss, unauthorised access, unwanted disclosure and unauthorised modification of your personal data.

Your data is only known to YincQ, your trusted partner for financial consultancy. YincQ never shares your personal data with other parties such as your employer or other financial advisers.

How much does a subscription to YincQ cost?

YincQ offers this portal through your employer with the aim of promoting your financial health. This is often offered as a service by your employer. Ask your employer for more information.

How can my employer get started with YincQ?

If your employer does not (yet) offer this, ask them to contact us via this website. You may soon be able to work on your personal financial wellbeing too.